This latest data point in the what's-a-biodollar-worth conundrum is less than straightforward to unpack, and might not have much relevance to, say, what Vertex might rake in by selling its European telaprevir milestones (recall that's $100 million for EMEA approval and $150 million more related to "launch" of the drug in Europe--whatever that means. Maybe it means reimbursement?).

But unpack it we will anyway. So Valeant is paying Dow's backers $115 million cash-money. (Those backers--which include VCs Essex Woodlands, Skyline Ventures, and Galen Partners have already done quite well; the initial deal last December netted them $277 million.) In exchange Valeant gets income rights to "all out-licensed and pipeline products" and is off the hook for a potential slew of milestone payments totaling $235 million.

First the royalty rights. Valeant's release today states that the initial deal excluded income rights related to the generic 1% clindamycin and 5% benzoyl peroxide gel (aka Sanofi-Aventis' BenzaClin) that was under FDA review at the time of the acquisition. That ANDA was approved in August 2009 and Dow partner Mylan Labs began marketing the drug, the first BenzaClin generic, later that month.

We're unsure what Dow's royalty was here, though Leerink Swann analyst Gary Nachman suggested in a note today that the profit sharing arrangement between Dow and Mylan may even exceed 50%. We don't have an exact estimate of what the generic will pull down revenue-wise, but Sanofi's branded product sold $221 million in the 12 months through June 2009 and Mylan has since captured a third of new prescriptions--so, depending of course on the generic price, it's not peanuts. To put the payments from that one drug into context, in 2008 Dow's revenue was $45 million, of which only $20 million came from royalties on a variety of others' products. This could be Dow's biggest earner, but still, it seems unlikely that the revenue from the Mylan royalty payments made up the bulk of $115 million price tag.

So if most of that $115 million is for the $235 million in milestone payments, and those milestone payments are, as the release announcing the December 2008 acquisition states, "based predominantly on the achievement of approval and commercial targets for certain pipeline products still in development," that leads us to believe two things.

First, Dow's backers got a pretty good deal. Dow's latest-stage proprietary dermatology projects were only in Phase II at the time of the deal and aren't expect to launch until 2012; plus milestones based on sales targets aren't easy to cash in. And second, because this is a pretty good deal for Dow, Valeant has some pretty high hopes for those projects.

Nachman also liked the deal from Valeant's perspective, and posited a third possibility. He said today that Valeant may be positioning the dermatology assets for a partnership--removing the $235 million in future milestones may make it easier to strike an alliance.

unadulterated version of image by flickr user mackius used under a creative commons license

Tuesday, September 29, 2009

Valeant/Dow: More Fun With Milestone Buyouts

What's the Hardest Job in the Biopharma World?

Maybe it's yours. Maybe it's Jeff Kindler's (keep Pfizer small? Yeah right.) Maybe it's Elan CEO Kelly Martin's(all those shenanigans with Biogen over the J&J Alzheimer deal, ouch).

Maybe it's yours. Maybe it's Jeff Kindler's (keep Pfizer small? Yeah right.) Maybe it's Elan CEO Kelly Martin's(all those shenanigans with Biogen over the J&J Alzheimer deal, ouch).Friday, September 25, 2009

Deals of the Week: Behold the Reimbursement Milestone

Much of the discussion at our recent Pharmaceutical Strategic Alliances meeting concerned the growing importance of factoring reimbursement hurdles into drug development decisions. It is becoming increasingly clear that if you haven't done so, your potential partner certainly will.

Much of the discussion at our recent Pharmaceutical Strategic Alliances meeting concerned the growing importance of factoring reimbursement hurdles into drug development decisions. It is becoming increasingly clear that if you haven't done so, your potential partner certainly will.

In fact we've heard of alliances in the works where haggling over how much of an approval milestone should be linked to reimbursement--and how achieving that reimbursement is defined--is a signficant part of deal negotiations. What ever happened to good old fashioned regulatory/approval milestones? From what we hear they're already a thing of the past.

Consider the discussion on Tuesday afternoon's panel about 'Reimbursable Innovation', where Genzyme EVP Peter Wirth noted that historically these issues haven’t been as important for his company as maybe they have been for others given patients' unquestioned need for the enzyme replacement therapies Genzyme markets. But as even Genzyme moves more into the mainstream, it's resulted in a new attitude at the Big Biotech. "We’re more aware of the need to demonstrate that there is a real benefit to the drugs we’re trying to develop," said Wirth.

So where therapeutic alternatives exist, Genzyme now does the financial modelling necessary to determine what an appropriate reimbursement would be and how the drug would be used for the benefit of patients; essentially Genzyme tries to duplicate the analysis done by the UK's NICE, whose CEO Andrew Dillon was also on the panel. "Not that we think it’s right, but we try to be pragmatic. If those criteria will be used to judge our drugs we should know going into the process" where we will stand, Wirth added. "We will quite deliberately gather the information that we think people like NICE will use in their decisions."

As such , reimbursement issues have killed deals, and in other cases changed what Genzyme and its ilk can afford to pay for a deal. Wirth said this isn't a frequent occurrance, but we bet that what isn't the norm now could be in the future, especially when comparative effectiveness really takes hold in the U.S.

David Mott, a self described "recently reformed drug developer" as CEO of MedImmune and now general partner at the VC New Enterprise Associates said that at MedImmune, "we changed our drug development path significantly, building [reimbursement concerns] into our target product profiles at the preclinical stage." By the time a molecule was going into Phase II the company was building in a pharmacoeconomic endpoint. Even good drugs would get killed: "If it’s another six weeks of survival it won’t be paid for and we kill the program," he said.

Now, wearing a VC hat, "just yesterday I was looking at a program and the key pushback was ‘is it innovative enough that it’ll be paid for in this day and age?'" he said.

So is there a silver lining? Mott may have pointed to one, if you call a re-emphasis on big advances and significant innovation (and the risk that comes with it) a good thing for the biotech sector.

After the genomics bubble burst, the way the biotech industry reacted to the punishment it received for risk was to go to incremental innovation. The companies that got started in 2002-2007 were relatively low innovation companies, he said, and for good reason: Big Pharma was trying to prepare for the 2012 patent cliff—and they were hungry for even incremental advances. What's more we had a public market that was more interested in less innovative and ostensibly relatively low-risk assets.

Today, there’s the near elimination of the IPO market, combined with what Mott reckoned was a significant improvement in later-stage Big Pharma pipelines. So biotechs "are now building what pharma’s going to need in five to seven years," he said, where pharma's early- or mid-stage pipeline looks thin. Taken together with the increased emphasis on reimbursement, "with our investments we’re really raising the innovation bar. It’s a triple whammy that’s hitting the pattern of investment in biotech."

So there you have it: higher reimbursement hurdles may translate into a renaissance in biotech innovation. Or at least a renaissance in the desire to invest in that innovation, if and when it comes along. While you're waiting for that, enjoy another installment of ...

Qiagen/DxS: With its $1.42 billion acquisition of Digene in mid-2007, Dutch sample prep and assay specialist Qiagen ratcheted up its visibility as a player in the battle for molecular diagnostics content. This week, it added DxS, a privately held UK-based provider of molecular tests including one for the mutant oncogene K-RAS, the companion diagnostic featured as of July on the labels

Leo Pharma/Warner Chilcott: On Wednesday Sept. 23, Leo Pharma announced—and closed—a roughly $1 billion cash deal with Warner Chilcott to regain U.S. licensing rights to psoriasis treatments Talconex, Talconex Scalp, and Dovonex, plus all partnered pipeline programs. For Leo, the deal marks a crucial step forward toward the company’s goal of building a meaningful U.S. commercial presence; for Warner Chilcott, meanwhile, the deal provides a sizeable chunk o’ change as it seeks to nail down funding for its $3.1 billion acquisition of Procter & Gamble’s pharma assets before the looming December 31 deadline for that deal. Moreover, the Leo/Warner transaction reinforces the notion that dermatology is no longer a therapeutic backwater when it comes to dealmaking. (Remember GSK and Stiefel Labs?) Derm’s renaissance is helped no doubt by its specialist focus as well as the diverse product offerings involved, ranging from OTC to prescription drugs. (Cuz, as we heard at this week’s PSA, diversity is a nice hedge these days.) When Warner announced the P&G deal in late August, many were surprised at the high price tag and the $4 billion financing from six banks. This deal with Leo gives Warner a quick way to pay down nearly a quarter of its debt, especially an expensive secured credit facility of $480 million that came due Sept. 23. (Coincidence?) If the deal gets Warner out of debt faster, the consultancy EP Vantage says it’s “reasonably priced” for Leo. Last year sales of Talconex, Talconex Scalp, and Dovonex pulled in $277 million, meaning the deal price is about 3.6 times those sales, which is consistent with the premium GSK paid for Stiefel. EP Vantage notes the deal could be considerably more expensive, however, if the acquired pipeline fails to pan out, given that Dovonex sales are forecasted to decline starting in 2012. FYI, this the second acquisition this month for privately-held Leo. On Sept. 2, the group acquired the derm assets of the biotech Peplin, an Aussie/California hybrid, for $287.5 million.—Ellen Foster Licking

Pfizer-Wyeth/Boehringer Ingelheim: In order to satisfy anti-trust regulators' concerns, it turns out Pfizer has to jettison some of Wyeth's animal health assets. Step right up, Boehringer Ingelheim! The German Big-but-Private Pharma's Vetmedica division has snapped up a series of Wyeth's Fort Dodge Animal Health units and assets. The deal is contingent on the closing of Pfizer's acquisition of Wyeth (expected this year) and resembles in many ways the acquisition of Merck's half of its animal health JV, Merial, by partner Sanofi-Aventis. Financials for the Pfieth/Boehringer deal weren't disclosed, but Boehringer gets mainly cattle and companion animal assets. More importantly, Pfizer's big acquisition doesn't go to the dogs. (Sorry, it was either that or a "barking up the wrong tree" metaphor.)--CM

image from flickr user wallyg used under a creative commons license

By

Chris Morrison

at

2:30 PM

0

comments

![]()

Labels: alliances, deals of the week, mergers and acquisitions

PhRMA Throws Bus Under the Bus

Remember the flap over candidates throwing allies, staff and pastors “under the bus?” It may seem like an eon; but it is only a little over a year ago that jettisoning a former supporter brought the phrase “throwing someone under the bus” into the common political parlance.

Remember the flap over candidates throwing allies, staff and pastors “under the bus?” It may seem like an eon; but it is only a little over a year ago that jettisoning a former supporter brought the phrase “throwing someone under the bus” into the common political parlance.

Now the phrase has true relevance to pharma politics. It creates the perfect metaphor to describe a change in tactics by the Pharmaceutical Research & Manufacturers of America (PhRMA), the trade association.

PhRMA is abandoning one of its high-visibility projects of the last four years, the patient assistance bus campaign in favor of a the larger goal of pushing through health care reform.

Ed Silverman writes about the trade association’s decision to put the bus back in the garage until the end of the health care reform effort in an article in “The Pink Sheet” Daily.

The association explains to Ed that it is too busy with health reform to take on budgeting issues like the cost of the bus campaign until the end of this legislative season.

That is clearly one reason. There is no question that PhRMA is busy with health reform and multiple mark-ups on Capitol Hill. And the association needs all of its resources to keep spending as heavily as it can (through partners like Families USA and the American Medical Association) to create the image of a strong consensus in support of overall health care reform.

From a strategic point of view, giving up the bus now makes perfect sense. The bus was just a vehicle (a big 18-wheel vehicle) for PhRMA to draw attention to its longer overriding objective: to get access for drug coverage to a good chunk of the 40-some million people who are insured and often can’t pay for drugs themselves. Offering assistance programs through the traveling bus was a good way for PhRMA to take charge of the issue of expanding drug coverage to the needy.

Health care reform moves that from a slow city-by-city or region-by-region effort to sign up people to the chance to legislate coverage to a large new market in one fell swoop. With that opportunity, it makes sense to change tactics.

It is worth noting as the bus goes back to the shop that it was also an effective way to counteract one of the most telling anti-industry metaphors of the last decade: the bus trips by seniors to Canada to buy cheaper drugs. PhRMA usurped the metaphor by sending a bus to the disadvantaged to sign them up for private assistance.

But now is the time for PhRMA to focus on opening the public pocketbook to drug coverage. The association and industry have been doing well at this effort: offering to pay $80 billion to pay for the cost of reform and stand with the White House has been a big plus.

PhRMA faces some big hurdles to the market expansion: take, for example, a recent change in the Senate Finance Committee mark (proposed legislation) that would remove the requirement for states to add drug benefits to all new Medicaid recipients. At first glance, this change would knock out a large proportion of the newly covered Medicaid beneficiaries in 2717 states from being assured of getting access to drugs.

That wouldn’t be good for PhRMA. The industry in this deal to get access to those Americans who cannot afford drugs now and to make sure that they get drugs without high out-of-pocket costs.

But getting coverage without a mandate on Medicaid to include drug programs for all beneficiaries won’t be the end of the road. PhRMA can always bring out the bus again to the states with coverage gaps and work at the state legislatures. The association should keep the tires inflated and the engine in tune while the bus is taking its break in the garage.

Thursday, September 24, 2009

PSA: Faster Than a Speeding NYC Cab, More Powerful than a Corporate Venture Fund

We got those kozmik post-Pharmaceutical Strategic Alliances blues again, mama, moving from our jam-packed coffee-and-schmooze-fueled confab in a charming old jewel of a Broadway theater near Times Square to the air-conditioned, seventh-floor hum of an office park in suburban Washington.

A bit of a letdown, really, though we acknowledge New York couldn't have handled PSA and the U.N. General Assembly all at once. We had to get out of town, fast.

So fast, in fact, that IN VIVO Blog is just now sorting through our copious notes on the second half of the conference. We've got plenty to pass along so, unlike our old pal Moammar Khaddafi, we'll get right to the point, and we promise you won't need simultaneous translation.

* The big takeaway from Wednesday's corporate venture panel was that CV funds have grabbed a more prominent role as the recession wears on. (What? It's over?)

Moderator and top Leerink Swann i-banker Tony Gibney noted that startups with corporate venture backers were more likely to get higher returns from M&A exits, especially if they had two or more corporates as investors. (Our colleague Ellen Licking had the lowdown in May's Start-Up.)

The one traditional VC on the panel was quick to give his corporate peers props: "We've definitely pulled back," said Jamie Topper of Frazier Healthcare Ventures in Seattle. "The financial risks have been very high lately, and the corporates have filled the gap and served the industry well."

Johnson & Johnson Development Corp. VP Asish Xavier said in the last 18 months his fund has even "played nice" and bailed out funds in its syndicate that haven't been able to pay their pro-ratas. Gibney said the corporate venture stance has quickly gone from "last passive one in" to aggressively forming companies and leading rounds.

Merck Serono sent Vincent Aurentz to talk up its new $54 million fund, launched in March. The fund bucks the general practice of keeping a firewall between the venture team and corporate R&D. Merck Serono is out to sniff out early-stage research for license or acquisition, said Aurentz: "We compare it to how much we would spend if we were to do this with internal research."

With one investment on its ledger so far, it's hard to say if the different approach will hamstring its efforts to woo startups into its portfolio, but other panelists took pains to emphasize the importance of keeping venture and corporate sides separate. Lauren Silverman of the Novartis Option Fund called her fund's firewall "strict," while Michael Diem of GlaxoSmithKline's SR One called his "serious." Asish Xavier said JJDC has a full-time employee to make sure the only information about its portfolio companies it passes along to J&J is already in the public domain.

* The final panel Wednesday discussed Big Pharma's sudden willingness to outlicense molecules that would otherwise sit on the shelf. Pfizer's Michael Clark, pinch-hitting for outlicensing chief David Rosen who was doing his civic duty as juror, noted the Esperion and RaQualia deals under its belt and promised that we'll see "a few more" deals by end of year. Eli Lilly's Gino Santini sang the praises of Lilly's Chorus project, the quasi-external development group that's supposed to move molecules to proof-of-concept faster than Lilly's main R&D organization. The goal, said Santini, is to have 50% of Lilly's pipeline eventually moving through Chorus.

But making Chorus bigger would ruin its nimbleness, so Lilly has a solution: Clone it. Santini didn't say when, but Chorus II and III are slated for "India and Indy." Hell, while you're at it, why not Indio? Or Indiahoma? OK? OK!

There are more juicy nuggets from PSA, but unless we cloned ourselves we'll miss the Nationals' 100th loss, not to mention the half-smokes and Gifford's double-dip. Check back with us tomorrow.

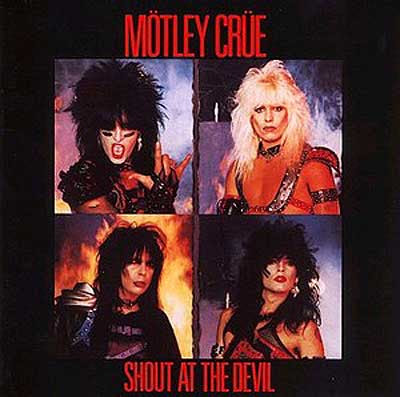

Financings of the Fortnight Is the One They Call Dr. Feelgood

For this fortnight's financing highlights we've selected a motley crew of creative deals that aren't your typical financing fodder, some real Live Wires. Huge anonymous private investments, dilution-sparing CEFFs, royalty monetization, massive mezzanines. But before we get to those we'd be fools not to point out the continuing surge of cash from follow-on public offerings and private placements in public biotechs.

For this fortnight's financing highlights we've selected a motley crew of creative deals that aren't your typical financing fodder, some real Live Wires. Huge anonymous private investments, dilution-sparing CEFFs, royalty monetization, massive mezzanines. But before we get to those we'd be fools not to point out the continuing surge of cash from follow-on public offerings and private placements in public biotechs.

This week Incyte Pharmaceuticals said it would raise as much as $145 million by selling up to 20.7 million shares in a follow-on offering. Oh, and it was also raising $250 million in convertible debt. Incyte joins fellow public biotechs Vivus (we knew they would--but more than $108 million?) and Rigel (which may also raise up to $108mm) in raising big FOPOs in the past two weeks. On the private placement side, there's Spectrum, going back to the well for another $50 million.

But enough vanilla--though we love vanilla, especially when there's lots of it. Let's get to the Wild Side. Shout at the Devil with us, it's time for ... Hybrigenics and Neurocrine Biosciences: Public biotechs remain creative in how they’re raising capital when the most common routes—either via PIPEs, which based on IN VIVO’s analysis largely seem to be successful for only those that have some significant impending clinical or regulatory milestone, or FOPOs, which are enjoying a resurrection—just aren’t an option. This past fortnight both Hybrigenics and Neurocrine Biosciences signed committed equity financing facilities which give them flexibility in drawing money when they need it while avoiding significant dilution.

Hybrigenics and Neurocrine Biosciences: Public biotechs remain creative in how they’re raising capital when the most common routes—either via PIPEs, which based on IN VIVO’s analysis largely seem to be successful for only those that have some significant impending clinical or regulatory milestone, or FOPOs, which are enjoying a resurrection—just aren’t an option. This past fortnight both Hybrigenics and Neurocrine Biosciences signed committed equity financing facilities which give them flexibility in drawing money when they need it while avoiding significant dilution.

French biotech Hybrigenics, which is listed on Euronext’s Alternext exchange, could pull in as much as €5 million ($7.3 million) through its transaction with Yorkville-managed YA Global Master SPV fund. Over the next three years, Hybrigenics has the option to draw down as much as €200k per tranche by selling YA new shares at a cost calculated on the percentage of a volume-weighted average. YA, which did a similar albeit more expensive financing with Dutch biotech Pharming a few months ago, can either sell the stock in the open market or hang on to it, as long as its ownership is capped at 9.9%. Hybrigenics is trying to exploit the potential of vitamin D analogs, which have been shown to slow down cancer cell growth. Most likely the money will go towards inecalcitol, the vitamin D analog Hybrigenics licensed exclusively from Merck KGAA division Laboratoire Theramex three years ago. The oral candidate is in Phase II in combination with Sanofi’s chemotherapeutic Taxotere for hormone-refractory prostate cancer.

Neurocrine’s deal with Kingsbridge Capital, also carrying a three-year term, allows the CNS and endocrine-focused company to sell up to $75 million in equity (no more than 7.8 million shares) at a 5-10% discount in tranches valued up to 2.75% of Neurocrine’s market cap at the time of the draw down, but no more than $15 million. Unlike the CEFFs Kingsbridge signed last year with Acadia and Epix, the transaction with Neurocrine doesn’t include warrants. In the last few years, Neurocrine has essentially had to start over after disappointing responses from FDA have all but killed its insomnia treatment indiplon. The company seems to have shifted focus now to elagolix, a gonadotropin-releasing hormone antagonist in Phase II for endometriosis. Neurocrine has been battening down the hatches; it initiated a restructuring plan in May that cut its R&D and administrative staffs, and the savings it’s realized seem to have paid off--at the end of the second quarter, it reported $38.6 million in cash and cash equivalents. --Amanda Micklus

Xoma: Another financing strategy that avoids dilution for shareholders is royalty monetization, and no one is more familiar with that strategy than Xoma. Last year the antibody developer borrowed $55 million from Goldman Sachs through a loan secured by the low- and mid-single digit royalties it earns on sales of Genentech’s Raptiva (efalizumab) and Lucentis (ranibizumab), and UCB’s Cimzia (certolizumab), which were all produced using Xoma’s bacterial cell expression technology. On September 14, Xoma announced it will fully repay what it owes on this loan--$44.2 million in principal and interest—based on the fact that Raptiva is no longer on the market, and the chance that royalties from Lucentis could drop dramatically should Genentech move manufacturing outside of the US in 2010. In addition to using $6.9 million in its restricted and unrestricted cash accounts, Xoma has set up two financing arrangements to get the rest of the money to pay back Goldman. First it has sold the future royalty stream from Lucentis to Genentech for cash proceeds of $25 million. And simultaneously, under an existing CEFF with Azimuth Opportunity, Xoma netted $12.3 million by selling 16.3 million shares for $0.76, an 11% discount (based on the ten-day average prior to deal announcement). Xoma’s CEO Steven Engle says elimination of the Goldman loan strengthens the company’s balance sheet and reduces costs, and puts it in a good position to start partnering talks for its lead antibody XOMA52, an interleukin-1 inhibitor expected to enter Phase II soon for Type II diabetes and cardiovascular disease.--Amanda Micklus

Zogenix: The specialty pharma play Zogenix looks to be another company prepping to test the IPO waters. Earlier this summer, the company won FDA approval for its needle-free sumatriptan injection, Sumavel DosePro, designed to treat migraine and cluster headaches within 10 minutes of onset. On Wednesday Sept. 23, the privately-held company announced it had pulled in the first tranche--$36 million—of a sizeable $51 million Series B from a syndicate of backers that included Clarus Ventures, Domain Associates, Abingworth, Scale Venture Partners, and Thomas McNerney & Partners. According to the press release accompanying the news, the mezzanine round will be used to prepare for the 2010 launch of Sumavel DosePro, including bolstering inventory of the medicine and hiring 105 sales reps to promote the product. Zogenix will also be relying on the marketing muscle of Astellas, which signed a U.S.-focused co-promote deal with the company in August to market the product to primary care physicians. As part of that deal, Zogenix remains in charge of manufacturing and distribution of the migraine medicine and will promote the product mainly to neurologists. Interestingly, the specialty co. will also book all sales; Astellas will be compensated based on sales in the PCP market. (How’s that for keeping the control with the smaller player?) This latest financing shows that Zogenix’s backers are remaining committed to the company—all told Zogenix has raised $78 million in venture funding and another $20 million in debt. If the continued strength of the follow-on market portends an opening of the IPO window, Zogenix is a logical company to attempt an IPO given it already has a marketed product and a deal under its belt. Certainly investors may view Zogenix’s strategy—differentiation via drug delivery technology inlicensed from Aradigm—as a less risky proposition than that of a discovery focused biotech such as Anthera or Omeros, who recently registered to go public.—Ellen Foster Licking

Seaside Therapeutics: This Fragile X and autism focused biotech company secured $30 million in Series B funding from an anonymous investor to progress its two clinical-stage compounds. The company plans to bring STX107, which is licensed from Merck, to the clinic in October, but has even greater hopes for its fully owned STX209 compound, which has reached Phase II in both Fragile X and autism, CEO Randy Carpenter told 'The Pink Sheet' DAILY. A selective gamma-amino butyric acid type B (GABA-B) receptor agonist, '209 inhibits glutamate signaling in the brain and, theoretically, should indirectly inhibit excessive mGluR protein synthesis that causes Fragile X, according to the company. STX107 works differently. The molecule is a highly potent, selective mGlurR5 antagonist, whose mechanism of action is based on the theory that most, if not all, neurological and psychiatric consequences of Fragile X are due to exaggerated signaling through mGluR5 receptors. Founded in 2005, Seaside has not raised venture capital funds, instead amassing $66 million through grants from the National Institutes of Health and foundations, along with the largesse of its most recent, anonymous benefactor. --CM

Tuesday, September 22, 2009

Pharmaceutical Strategic Alliances: The Advantages of Scale, American Soccer, and the Cost of 'Virtual Critical Mass'

We concede that our blog post title is a little confusing but bear with us. This morning during one of the first sessions of our Pharmaceutical Strategic Alliances meeting we held a debate around the question of whether supersizing pharma provides a compelling strategic advantage in R&D.

We concede that our blog post title is a little confusing but bear with us. This morning during one of the first sessions of our Pharmaceutical Strategic Alliances meeting we held a debate around the question of whether supersizing pharma provides a compelling strategic advantage in R&D.

Let us say right away that even before various points of view were aired, the bigger-is-better crowd on stage (Merv Turner from Merck & Co., Thomas Hofstaetter from Wyeth, and Elsevier's Roger Longman) out-numbered the small-is-beautiful gang (Elsevier's Melanie Senior and Ipsen CEO Jean Luc Belingard; as a consultant it was noted that fellow panelist Raj Garg from McKinsey would argue for both sides), and the conversation for the most part reflected that.

The discussion was interesting and touched on many points--some outside the scope of R&D, but all on the Big/Small topic: how to maintain focus in large organizations, various models for creating smaller units within larger organizations, externalization, regionalization, etc. Talk eventually wound around to how smaller companies could hope to compete in particular therapeutic spaces without necessary size, and really maximize the value of their medicines for shareholders and patients.

The Big Pharma contingent, not unsurprisingly, argued that without the necessary critical mass both industry and patients lose out, particularly in primary care indications. Belingard countered that there was plenty of 'virtual critical mass' out there--development and commercialization partners can be found, though this comes at a cost--provided you had the right asset (he used the example of Ipsen's GLP-1 analogue). The panel agreed, though some argued this cost is in some cases prohibitive even as such moves act as a hedge against development risk.

Merv Turner made the point that especially in primary care you needed size to absorb the shocks common in the pharmaceutical business--the Vytorins and the Vioxxes--to which Melanie raised the point that in any case isn't pharma moving away from its primary-care centric business model. Diseases, from cancer through heart disease, after all are increasingly recognized as multifactorial, heterogenous groups of related maladies, and in the future may be treated as such.

As he is wont to do, Turner, head of strategy at Merck, came up with a soccer (football/fussball, whatever) analogy.

"You can reduce cardiovascular mortality by 50%" by using statins, he said. "That means 50% cardiovascular disease is unsatisfied. Is that 50 different small diseases or one large one? Personalized medicine is like soccer in the US: it's the game of the future and always will be."

To which we say, somewhat sarcastically: you just wait til Philadelphia Union takes the field next year ...

Check out IN VIVO Blog, 'The Pink Sheet' DAILY, and our various twitter feeds (@invivoblogellen, @invivoblogalex, @invivoblogchris, @ebiwendy, @pharmalot) for more missives out of PSA.

By

Chris Morrison

at

11:15 AM

2

comments

![]()

Labels: conference, PSA, research and development productivity, research and development strategies

Friday, September 18, 2009

Deals of the Week: Hey Everybody, Let's Get Small!

Steve Martin's not the only one getting small, though we hope the rest of this week's newsmakers aren't getting small while driving. That would be bad, and probably against the law.

Steve Martin's not the only one getting small, though we hope the rest of this week's newsmakers aren't getting small while driving. That would be bad, and probably against the law.So who's shrinking--but not from the DotW spotlight--this week? Elan and Johnson & Johnson got a little smaller to satisfy Elan's Tysabri partner Biogen Idec. Of course this downsizing--$115 million knocked off the price of the companies' once-$1.5 billion deal--is accompanied by J&J forfeiting its right to finance Elan's acquisition of Biogen's half of Tysabri, should Biogen get acquired itself. Small questions? The answers are here.

Meanwhile Arena Pharmaceuticals saw its shares rise on the promise of shrinking waistlines, joining fellow obesity drug hopefuls Vivus and Orexigen with positive Phase III data. We interjected our own little "excuuuuuuuuuuse me" earlier this week but we won't let our small concern spoil the diet-drug party. We still expect deals for these compounds, just, you know, smaller ones.

Of course nobody has out-smalled Eli Lilly this week. The drugmaker said on Monday it was restructuring to the tune of 5,500 fewer jobs to save $1 billion by 2011. The new blueprint lacked much in the way of small print, but we'll have some more details for you in Monday's "The Pink Sheet'"

But not every ambition was small. Omeros and Anthera each announced plans for an IPO--no small feat in today's market--which we suppose makes them the week's Two Wild and Crazy Guys.

Finally--and we're going to blow your mind here if the various late-70s era Steve Martin references haven't already--can you be Big and Small at once? Find out next week as we explore that main theme at our Pharmaceutical Strategic Alliances meeting in New York City. Can't make it to the meeting? Check out the blog and our twitter feeds for regular updates.

Until then, settle in for a set of deals that are definitely not small potatoes. It's ...

ESBATech/Alcon: In what looks like a winner for the Swiss biotech's VC owners, ophthalmology specialist Alcon is buying antibody fragment technology play ESBATech for $150 million--just over twice the value of the cash those VCs ploughed into recapping the company via two Series B raises in 2006/2008. ESBATech's shareholders will also be eligible for a package of CVRs that could total $439 million in R&D milestones, and oh-by-the-way, they also get to keep hold of the ESBATech IP outside the ophthalmic space. Those investors--B round leaders SV Life Sciences, Clarus Ventures, HBM BioVentures and HBM BioCapital, and earlier backers Novartis Bioventures, Bio Medinvest and VI Partners--have spun out Delenex, which will focus on ESBATech's legacy areas of rheumatology and respiratory disease. The sell-and-spin-out strategy has paid off in the past (think NovaCardia/Sequel, Peninsula/Cerexa, etc.), though this may be the first time it has been tried with this kind of platform technology company (or the first time it doesn't involve Domain Associates?). More typically shaving off therapeutic rights to platform technologies is done via the types of strategic alliances we've seen from the likes of Sirna (now part of Merck, of course) in RNAi.

Pieris/Allergan: Which brings us to our next deal, a strategic alliance between Pieris Proteolab and Allergan for ophthalmic uses of the biotech's Anticalin technology. (Anticalins are a new class of biologic drugs based on naturally occuring lipocalin proteins.) Pieris gets $10 million up-front, and although the two companies will work together on optimizing existing molecules and designing new ones, Allergan will pick up the discovery and development tab. Allergan will then have the option--at some unspecified point in the development continuum--to license exclusive worldwide rights to the molecules that come out of the collaboration (did you think we'd make it a week without an option-alliance to write up?). The companies were mum on the rest of the financials, but the Allergan's-paying-for-everything arrangement makes it quite different from the typical risk-sharing nature of most option-alliance deals, suggesting perhaps the terms aren't as sweet on the back-end for Pieris. The deal is the first major collaboration for Pieris in several years, and follows on a 2008 $38mm Series B led by Orbimed Advisors.

BMS/Taisho: Taisho Pharmaceutical, the big dog of the Japanese OTC market, has acquired from Bristol-Myers Squibb Co. the pharma's Asian (but ex-China and ex-Japan) OTC assets. Taisho is also buying BMS's Indonesian infrastructure through the acquisition of BMS's 98% stake in PT Bristol-Myers Squibb Indonesia Tbk. All told the price comes to $310 million, a figure some Japanese analysts considrered too high, report our friends at PharmAsia News. For Taisho the move is part of a long-term policy to expand its OTC presence in Asia, and expand it has: through the deal Taisho is getting trademarks and registrations and IP for a diverse set of self-medication brands in eight Asian markets (Indonesia, the Philippines, Thailand, Malaysia, Singapore, Hong Kong, Taiwan and Macau) and trademarks and patent rights for those products in 12 further countries from Afghanistan to Papua New Guinea. Meanwhile BMS continues down the road of focusing on prescription biopharma, offloading non-core assets as it adds to its string of pearls.

Ambrx/Wyeth: Protein optimization play Ambrx is branching out from its secreted protein focus into antibodies and antibody-toxin conjugates, and has inked a deal with about-to-be-pfizery pharma Wyeth. The worldwide alliance covers three targets; Ambrx gets an undisclosed upfront payment and research funding, payments on preclinical, clinical, regulatory and commercial milestones, and tiered royalties on any sales. Wyeth joins existing Ambrx partners Merck-Serono, Lilly and Merck & Co. in accessing Ambrx's sought-after technologies, ReCode and EuCode. These platforms essentially allow for site-specific integration of Ambrx-made amino acids into various proteins. These amino acids are then conjugated--to PEG, to a toxin, etc.--creating molecules with improved properties or killer payloads. Make sure to check out 'The Pink Sheet' DAILY for the skinny on the new deal.

By

Chris Morrison

at

12:30 PM

0

comments

![]()

Labels: alliances, deals of the week, mergers and acquisitions

Wednesday, September 16, 2009

From PharmAsia News: An Interview with Sanofi-Aventis China R&D Head Frank Jiang

Part of the reason behind Sanofi-Aventis' success in emerging markets is its aggressive strategy in China, where it currently has 3,500 employees in vaccines, R&D, commercial operations and manufacturing. Sanofi-Aventis China R&D Head Frank Jiang sat down with PharmAsia News editor Tamra Sami to discuss the environment in China and how Sanofi is approaching R&D there.

Biotechs are blooming in China, and the industry is predicting that Shanghai will look much like San Diego in a few years, Sanofi-Aventis China R&D Head Frank Jiang told PharmAsia News.

With the cost of developing a drug now $1 billion, and half of drugs failing in late-stage trials, there is an even greater need to break down traditional "linear" drug development and come up with different models. Big Pharma is increasingly looking outside of its walls for sources of innovation both for drug development and for biomedical diagnostic tools.

"But we need a way to match new scientific tools and approaches with clinical design - not the kind of clinical design we do today," Jiang stressed.

"Biotech in China is blooming, but we have not seen any global product coming out of China, and the challenge for China biotechs is that the best science remains in the universities and academic institutions, many being government-supported programs," Jiang said.

Perhaps an even bigger drawback for Chinese biotechs is the Chinese culture itself, which can be risk-averse. Most drugs fail, "so you need to have vision, resource, infrastructure and the patience to see the outcomes," he said.

Also, the ability to fail a compound earlier is an important advance for the industry.

Most multinational pharma companies now include China in their global drug development programs, and China is playing an increasingly important role in companies' R&D strategies, partly because of the country's dynamic growth and ability to be more adaptive.

"This is the best time to work here - change is so fast; we are still building, which is somewhat different from Japan," Jiang said.

China contributes close to 10 percent of Sanofi's global patient population for its clinical trials. China's State FDA regulations specify that for a drug to be approved in China, there must be a minimum of Chinese patients - in most cases 240 - in a Phase III trial, Jiang said.

He noted that China has participated in several global mega trials, including one with a total patient population reaching 21,000.

It would be difficult to show any statistical significance with 240 patients out of a total patient population of 21,000, but if you stack the patient population to include early responders using predictive tools such as biomarkers, you can shrink the sample size, he said.

"We are working very closely with SFDA and [the agency] is very interested in how to utilize adaptive trial designs," he said, noting that during a workshop presentation in March, SFDA Center for Drug Evaluation reviewers were especially interested in how to use biomarkers to identify those early responders "so you can decrease the sample size and get a response in a much larger differential."

Adaptive trial designs use accumulating data during the study and then look at that data at pre-determined interim points, which then determine how the latter part of the study is modified without undermining the validity and integrity of the design. Those modifications, however, are not ad hoc - they are prospectively built into the trial design.

"If an interim look shows that the patients with 'gene X' are responding better to a drug, why would you continue to test patients that are not responding who do not have gene X?" Jiang asked.

Another way of conducting adaptive trials is to start out with multiple different dose arms, and then drop one or two of the most inferior treatment arms based on pre-defined rules. Jiang said this is one simple way that multinational companies can conduct adaptive global trials that not only will avoid unnecessary exposure of patients to inactive treatments, but also increases the success rate of clinical trials.

The "key difference between traditional design and adaptive design is that traditional study design is very rigorous and focused, which is good for scientific hypotheses to be tested," Jiang said, "but it is fixed and inflexible in that you do not allow new information to help you to improve the outcome of the remaining part of the study."

"If you test a new compound for lung cancer - you take all lung cancer patients that match inclusion criteria and if 20 percent of patients have tumor shrinkage and this compound has a comparable safety profile to the existing drugs, this drug may be approved," Jiang explained.

"But what we are doing very poorly is knowing what features of those 20 percent of responding patients are. As a result, doctors don't know which patients will respond and may prescribe the drugs to those 80 percent non-responders who are then exposed to an inferior treatment and potential side effects. Adaptive design can address this."

"You can only do scientific assumptions to the best of your knowledge at that point in time, and if at the interim look, for example, you see that your mortality reduction is not 10 percent as you assumed at the design stage - but 5 percent, still a clinical meaningful advantage - you should enlarge your sample size (based upon a pre-specified statistical method) so that you will have enough power to detect that 5 percent advantage."

In the past, he said, a trial would have failed, but with an adaptive design, premeditated looks at the data are allowed to allow a drug sponsor to enlarge the sample size to demonstrate the efficacy and safety of a drug while maintaining scientific integrity of a clinical trial.

For the time being, companies are not conducting adaptive trials in China, Jiang said, but it will likely happen once a few hurdles are cleared.

The biggest hurdle now is the lengthy timeline for clinical trial approval to begin Phase I-III studies, and this is the main reason that China is merely a participant in global trials and not leading the way, he said.

"We do want to invest in China - we have perhaps hundreds of different trials - but the number we can actually bring to China is only a small fraction," Jiang said. For trials that need to be completed in a year, China would miss out completely, he said, because "we just don't have time to enroll the patients."

Still, he does see progress and SFDA and CDE are "acutely aware of this issue and are doing everything they can to shorten the timelines," he said.

For example, SFDA recently instituted a special approval procedure to fast-track certain drugs, and is increasing resources and investing in technology and infrastructure that will one day support multinational and domestic companies to bring in more innovative medicines.

[Editor's note: This is part one of a two part interview; look for part two in an upcoming issue of PharmAsia News. Want to know more about growing your pipeline in Asia? Don't miss the PharmAsia Summit Oct. 26-28 in San Francisco where Frank Jiang will participate in a China R&D roundtable discussion with other pharma leaders in China. Click here for more information.]

By

Chris Morrison

at

8:20 AM

0

comments

![]()

Labels: China, emerging markets, PharmAsiaNews, research and development strategies

Tuesday, September 15, 2009

NICE and the Definition of Innovation

What 'innovation' means to NICE--or at least, how it takes innovation into account in its cost-effectiveness assessments--may yet become a little clearer. Tomorrow the National Institute of Clinical Excellence will hold one of its regular public board meetings and item 7 on the agenda is the agency's response to the Ian Kennedy report.

What 'innovation' means to NICE--or at least, how it takes innovation into account in its cost-effectiveness assessments--may yet become a little clearer. Tomorrow the National Institute of Clinical Excellence will hold one of its regular public board meetings and item 7 on the agenda is the agency's response to the Ian Kennedy report.

Vivus Can Teach Old Drugs New Tricks, But Does It Have a Bidil Problem?

A lot has been said and written over the past week about Vivus' obesity drug candidate Qnexa, which is a combination of two older, approved products. Its Phase III data was surely quite impressive, as impressive perhaps as the obesity market has been intractable.

A lot has been said and written over the past week about Vivus' obesity drug candidate Qnexa, which is a combination of two older, approved products. Its Phase III data was surely quite impressive, as impressive perhaps as the obesity market has been intractable.But setting aside questions about safety and efficacy--lets assume the company is on to a winner in those respects--and likewise ignoring the not-so-successful track record of existing drugs approved to treat obesity (two recent posts by our friends at Bnet make each of those points well, here and here), there are some complicating and inconvenient factors for Qnexa that aren't getting much play.

First some background. On September 9 the company announced spectacular weight-loss data from two Phase III trials; one study showed an average of 37lbs (14.7%) weight loss for patients on the drug for 56 weeks. The news, which sent Vivus shares up a whopping 70%, also put pressure on late-stage rivals Arena and Orexigen.

(As an aside, the fact that there are three Phase III obesity drug candidates out there, each showing a little extra leg for eligible pharma partners and each surpassing FDA's 5%-weight-loss hurdle guideline for obesity drugs, is a drug-journo's dream, so expect lots more stories on these candidates from your favorite news outlets.)

Arena is developing the serotonin activator lorcaserin (a first Phase III was successful, showing average 5.8% weight loss; a second Phase III trial is expected to report out any day now) and Orexigen is developing Contrave, a combination of the antidepressant bupropion (aka Wellbutrin) and a sustained release form of naltrexone, a an opioid blocker marketed to treat various addictions. Contrave's Phase III data in July was also solid, showing an average 6.1% and 6.4% weight loss in two trials.

Each company even managed to take advantage of their good data and investors' returning appetite for biotech: Arena raised more than $52 million and Orexigen netted $81.6mm in a FOPO on the backs of their respective news. Vivus has yet to pull the trigger on a stock offering (it had just over $144mm in cash and equivalents at mid-2009).

OK. So far, so good for Vivus: it has shown the most impressive results and could therefore ink a successful partnership and have a leg up on its rivals for share in tomorrow's obesity-drug-marketplace. Perhaps! But Qnexa is, like Contrave, a combination of two generic drugs: the stimulant phentermine and the epilepsy and migraine treatment topiramate. Vivus' explanation for how the drugs work together is here.

Now we are aware that this isn't exactly the same scenario, but Qnexa reminds us of another generic-generic combination that was destined for blockbuster-status (only to fall very flat): Nitromed's Bidil. And why did Bidil hit the skids so spectacularly? One word: Pricing.

It's by no means a perfect comparator, but the similarities are there. Bidil is a fixed-dose combination of the generics isosorbide dinitrate and hydralazine hydrochloride used to treat heart failure in black patients. The drug showed stunning results in this population, FDA approved it in June 2005, and then Nitromed priced it at $1.80 per pill--or about $5.40 per day (up to as much as $10.80/day depending on a patient's dose).

That price was four times the retail cost of the combined generics and much higher than even industry analysts thought Nitromed would go. FDA said yes on safety and efficacy, but would doctors prescribe it at that price? Would payors foot the bill? See this IN VIVO feature from a few months post-launch for all the details.

Suffice it to say, although the company had blockbuster dreams, Bidil never took off, at least in part because of its price relative to generics (though the company surely tried to nip generic prescribing in the bud, going as far to file a Citizen's Petition to get FDA to reiterate that there was no generic substitute for Bidil; FDA complied). Did Nitromed strike out while swinging for the fences, when it could have settled for a nice double?

Now, again, Qnexa isn't Bidil, and the circumstances aren't identical. The components of Qnexa aren't available commercially right now in the exact doses that Vivus has tested in combo. And Qnexa's formulation involves controlled release, minimizing certain side effects like tingling, which is related to topiramate. Doctors also "won't take on liability of prescribing off-label when there is a drug approved by FDA," Vivus COO Peter Tam told our colleagues at 'The Pink Sheet' DAILY last week, adding "we are not concerned about generic substitution." (Orexigen execs are similarly sanguine about generics.)

But a highly priced Qnexa may still face some of the same hurdles as Nitromed's Bidil. Off-label prescribing may become a factor. Payors that universally prefer behavioral changes--diet and exercise--in this kind of market may balk at reimbursement for all but the most intractable of patients, limiting Qnexa's market.

Orexigen has in fact said that they planned to price Contrave roughly in line with or even lower than the total cost of its component generics, though at about $8 per day for bupropion and naltrexone generics (a price quoted by Orexigen execs during a presentation in January) that isn't exactly a low ceiling. Topiramate and phentermine cost considerably less, under $1/pill for 100mg topiramate and just over $1/pill for 15 mg phentermine at drugstore.com, for example. (Qnexa's highest dose in Phase III--the one that achieved the best results--was 92mg of topiramate plus 15 mg of phentermine, once a day.)

Now, another potential difference between Bidil and--should either drug make it to market--Qnexa and Contrave: Nitromed tried to sell Bidil itself, without a partner. Both Orexigen and Vivus are out pounding the pavement, in search of pharmaceutical partnerships, or perhaps acquirers, to provide the necessary commercial infrastructure for selling a mass market obesity drug.

We won't be surprised to see either company land a deal, though we have our doubts--because of the pricing problem described above--that either drug will land the kind of blockbuster alliance or acquisition that each company is surely hoping for. What are we expecting: lots of risk-sharing stuff like sales milestones, lower-than-typical-Phase III upfronts.

In short, maybe a nice double.

By

Chris Morrison

at

7:30 AM

5

comments

![]()

Labels: Drug Pricing, generics, marketing, research and development strategies

Monday, September 14, 2009

Is There a Drug Lag? We Still Don't Know

Is there a difference in the pace of approvals between the US and Europe? We asked, and you answered, with a clear, unambiguous "maybe."

The results of our poll are below, and glance at the responses makes it clear: about half of you think that yes, FDA has become too conservative and therefore drugs are more likely to make it to market first in Europe. And about half of you think there is really no difference.

There isn't much support for the idea that maybe the problem is that Europe hasn't learned to be appropriately cautious. We, however, feel compelled to point out that many in FDA might feel that way, raising the distinct possibility that if there is a drug lag, it will only close if Europe starts to slow down.

Thanks to all who commented, including a few who proposed "other" responses. Our favorite: "Both yeses are correct."

Elan and J&J: We Can Work It Out?

The companies have to renegotiate their $1.5 billion pact, which gives J&J 18.4% of Elan and slight majority control over Elan's Alzheimer's disease programs, because a federal judge ruled Sept. 3 that a component of the deal violated a longstanding contract between Elan and Biogen Idec. Elan didn't even disclose the component for three weeks because its outside counsel Charles Gilman of Cahill, Gordon & Reindel didn't think it was material. That's what he told the court Sept. 3.

Biogen wasn't amused. Soon after the side deal came to light in late July, it accused Elan of breach of contract. The companies have been development and marketing partners for nearly a decade on Tysabri, a multiple sclerosis drug that has slowly gained the trust of patients and doctors after it was taken off the shelf for a year soon after its late 2004 launch. Tysabri recently hit $480 million in half-year sales, though analysts are split how much larger its market will grow, due to its continued link to a rare but deadly brain infection.

The Journal reported J&J wants to shave at least $100 million from the equity portion of the Elan deal, with the $500 million committed to the Alzheimer's development to remain unchanged.

The difference is a pittance to J&J, but Elan has tabbed the cash from J&J's equity purchase to pay down debt. It had $1.8 billion in long-term debt at the half-year mark.

After browbeating Biogen's lawyer throughout the hearing, Judge Deborah Batts ruled in his favor, setting off choruses in our heads, if not in the courtroom itself, of "Cruel to Be Kind." She ordered Elan to fix the breach of contract by Sept. 26 or risk losing to Biogen its half of the Tysabri rights. The breach centered on Elan giving J&J the right to finance a buyout of Biogen's half of Tysabri, if and when Biogen is ever the subject of a change of control.

Over Elan's objections, the judge ruled the financing right was, in legal terms, an "assignment of rights" -- Elan handing its power in the Tysabri relationship to J&J without Biogen's consent. The case came down to this: Where there's money, there's power. Elan said J&J's money -- its option to help finance a future buyout -- was merely a banking relationship and didn't give it power until the money was in Elan's hands. Biogen said no, that money is power even before changing hands, and the judge agreed.

Speaking of "Money," we wonder if Pink Floyd's version ever made the in-flight rotation on the private company planes that raised so much investor ire. I think I need a lear jet, indeed.

For those who want to parse the legalese, the case turned on the phrase "the sole discretion of the non-acquired party." That phrase is in the Biogen-Elan contract, written up in 2000. If either partner is ever bought out, the other -- the "non-acquired party" -- must decide whether to enter negotiations to buy out the Tysabri rights from the acquired party. The judge said J&J's financing option shifted that discretion to J&J, and she pointed to language in the Elan-J&J agreement to make her ruling.

The agreement, still under seal but quoted extensively in the Sept. 3 hearing, said that once Biogen is subject to change of control, Elan must take up negotiations for Tysabri "in a manner directed by J&J." Elan would sit at the negotiating table, but J&J would whisper in its ear. Or, in the words of Biogen outside counsel Michael Gruenglas of Skadden, Arps, Meagher & Flom of New York on Sept. 3, "In section 2B it says that, starting in the second line, J&J shall give written notice to Elan either instructing Elan to exercise the Elan right and to undertake the [negotiating] process provided for in [the Biogen-Elan contract]. Elan's not in the driver's seat. They're not even in the car." Beep-beep, beep-beep, yeah!

Elan counsel Gilman pointed to wording in the J&J-Elan contract that guaranteed Elan would keep all its rights, but the judge, in one of the rare instances she challenged Gilman during the hearing, shot back that just because it says so in the contract doesn't mean it's true.

J&J can walk away from the entire Elan deal by Tuesday, Sept. 15, so the clock is ticking.

If indeed Elan and J&J renegotiate their contract to eliminate the offending financing option -- or more specifically the apparent power over Tysabri rights the option seems to give J&J -- the next question is whether Biogen will approve it or go for the throat. Bet on the former: Gruenglas in court said more than once that Biogen doesn't want to grab Elan's Tysabri rights, it only wants Elan to "cure" the breach. Though take note: More than once in this case things have not been as they seem. That certainly sounds like a song waiting to be written.

Friday, September 11, 2009

DotW: Not Dead Yet

Obama's rousing speech on the issue of health care reform Wednesday night ensures that the issue is not dead yet. Given the number of democrats in Congress the odds of no bill passing hasn't really ever been the issue. The question has always been: can we get a bill passed that provides substantive change? Did those odds go up Wednesday night? Maybe.

They were certainly helped by Congressman Joe Wilson, whose outburst went a long way to proving Obama's point that the entire debate has been side-railed by incivility. (Though many have suggested Wilson must have confused Capitol Hill with Britain's House of Commons, Ezra Klein helpfully points out the infraction even broke the decency rules of our loud and unruly neighbors across the pond.)

True to form, Obama lost no time in seeking a teachable moment, using Wilson's quickly issued statement of regret to his advantage: “I do think that, as I said last night, we have to get to a point where we can have a conversation about big important issues that matter to the American people without vitriol, without name calling,’’ he said in response to questions from reporters at his Thursday Sept. 10 Cabinet meeting.

But despite checking off a number of boxes on a must-do list that included outlining both the dangers of maintaining the status quo and the specific advantages of his plan, many wondered in the aftermath whether Obama did enough for a cause that has become a linchpin of his presidency. Over at his blog at the New Yorker, Atul Gawande, whose work is now required reading in the Oval Office, soberingly summarized his take as follows:

"He checked all the boxes on my list. And yet I remain concerned that he may not have done enough. Our current health-care system—-bloated, Byzantine, and slowly bursting—-presents seemingly insurmountable difficulties. It is too big, too complex, too entrenched. What may be most challenging about reforming it is that it cannot be fixed in one fell swoop of radical surgery. The repair is going to be a process, not a one-time event. The proposals Obama offers, and that Congress is slowly chewing over, would provide a dramatic increase in security for the average American. But they will only begin the journey toward transforming our system to provide safer, better, less wasteful care. We do not yet know with conviction all the steps that will rein in costs while keeping care safe. So, even if these initial reforms pass, we have to be prepared to come back every year or two to take another few hard and fiercely battled steps forward."Not very uplifting is it?

Outside of health care, the week was full of "not dead yet" moments. Swine flu is an epithet that continues to hog the limelight, despite pleas from Agriculture Secretary Tom Vilsack and the pork lobby. (Actually AP style says it's acceptable to use "swine flu" on first reference to H1N1. Seriously, we keep track via twitter.) Meanwhile, Almirall is determined to resurrect its COPD drug aclidinium. And then there's Dynavax's Heplisav.

In biopharma deal-making, the Elan-JNJ deal is certainly a candidate for "not dead yet" but the clock is ticking, with next Tuesday the deadline for the two companies to reach a resolution on their Alzheimer's collaboration after a potential side deal linked to Tysabri caused Elan's other partner Biogen to cry foul.

For more dealmaking antics of "not dead yet" biotechs (and a few healthy ones too) read on for an always looking on the bright side edition of...

Biotechnol/Digna Biotech/Genentech: Despite management changes that appear to upend the scientific culture at Genentech, making it worthy of the appelation Rochentech, Genentech is not dead yet, announcing an out-licensing deal to a biotech consortium with locations in Portugal and Spain. Under the terms of the deal, Biotechnol and Digna Biotech will develop and commercialize Cardiotrophin-1 for potential use in specific liver indications, gaining full access to Genentech's CT-1 IP in return for paying an undisclosed up-front. If CT-1 proves to be a major success story, Genentech (and by extension, Roche) isn't shut out of future upside either. The big biotech has an exclusive option to development and commercialization rights to CT-1 proteins in the liver disease arena. If it exercises said options Genentech will have to reimburse the consortium its development costs and pay pre-agreed milestone payments and royalties on sales.

Genzyme/Targeted Genetics: Targeted Genetics is still on life support, but refuses to go gentle into that good night. (We hereby nominate the company for DOTW's award for best interpretation of the Black Knight.) Whether the company has found the holy grail to success is another story. As Luke Timmerman at Xconomy reports, the biotech pulled itself back from the brink with an 11th hour deal, selling off its most valuable intellectual property--its gene therapy manufacturing and adeno-associated viral vector technology--to Genzyme for $7 million. There's probably no other biotech that typifies the boom to bust, scrappy nature of biotech than Targeted Genetics, which spun off from Immunex in 1992 in the heyday of gene therapy's hype, has yet to cure anything, and has burned through more than $300 million in investor capital. But even this deal still means the company is running on fumes. Targeted Genetics gains just $3.5 million at the deal's close and another $3.5 million in installments tied to the successful completion of "specified transfer plan deliverables." Even as most other big pharma and big biotech tread cautiously when it comes to risky technologies such as stem cell therapy and gene therapy, Genzyme has been one of the few early adopters as it attempts to bolster its technical capabilities beyond the comparatively simple field of enzyme replacement therapy. Among the Big Biotech's gene therapy deals: two tie-ups in 2007, including one with Fovea for a gene therapy for retinal dystrophies and a manufacturing deal with Chinese biotech Sunway to help produce Genzyme's gene therapy candidate, Ad2/HIF-1a, being studied as a treatment for peripheral arterial disease. It's possible the Targeted Genetics deal is a recognition by Genzyme that it needs help with its AAV manufacturing process (In 2007, Genzyme brought in Sunway to design, fund, and perform Phase I and Phase II trials in China for various forms of PAD, with Sunway producing the molecule for clinical trials using Genzyme's manufacturing process.)

Abbott/Evalve: Percutaneous heart valves represent one of the hottest areas in the cardiovascular device industry today. What was once a one-on-one competition between a small company (Corevalve) and a big one (Edwards Lifesciences) is now turning into a clash of Titans. In March, Medtronic paid almost $1 billion to become the dominant player in the market for percutaneous aortic valve repair, via its acquisitions of European market leader Corevalve and next-generation company Ventor Technologies. Now Abbott enters the game, offering $730 million ($320 million in cash and potential milestones worth $410 million,) for Evalve, which is years ahead of competitors in the market for percutaneous mitral valve repair, a market that dwarfs that of aortic valve repair and replacement. There are 8 million people in the US with significant mitral valve regurgitation and 600,000 new cases diagnosed each year. If these numbers sound very similar to the immense problem of heart failure, that’s no coincidence. MR is implicated as both a byproduct and a cause of chronic heart failure. Evalve’s MitraClip is the first non-surgical mitral valve repair device on the market—in 7 countries in Europe--and a US approval is anticipated early next year. Abbott announces this new purchase for its interventional cardiology division on the heels of the launch of its Xience drug-eluting stent, allowing the company to capitalize on its popular stent to build a bigger cardiology business not wholly reliant on DES, a dependency that hurt competitor Boston Scientific because it had no second act after launching its Taxus stent. Abbott won’t be exposed to the same risk; for one thing, much of its market cap is sustained by its pharmaceutical business, and in devices, it’s clearly not just going to sit on its laurels. --Mary Stuart

By

Ellen Licking

at

12:55 PM

1 comments

![]()

Labels: Abbott, alliances, deals of the week, Genentech, hostile takeovers, medical devices, reverse mergers